SARFT will resolutely eradicate stubborn diseases such as the flow theory of sky high price film pay

Following the fact that actor Fan Bingbing was fined 884million yuan for tax related issues such as "yin yang contract" and "sky high film remuneration" in 2018, netizens recently reported that actor Zheng Shuang "obtained an abnormally high film remuneration of 160million yuan and used the" Yin contract "to increase the capital of a company by 112million yuan on suspicion of tax evasion", which once again triggered heated public debate.

(source: China News Network) < /p >

[related news: "yin yang contract" has been banned repeatedly? Decryption of sky high price film pay money laundering routine] < /p >

Relevant management departments need to establish a regulatory pattern of "content + capital + tax" for cultural listed companies from the perspective of ideological control to prevent and resolve financial risks and cultural capital, strictly investigate the illegal acts of film and television listed companies such as false statements and fraudulent issuance, prevent the risk of equity pledge, strictly control the "high leverage" projects such as film and television real estate, effectively guide the operation of capital, and let artists return to the origin of creation

There is no trivial matter in literature and art

Following the fact that actor Fan Bingbing was fined 884million yuan for tax related issues such as "yin yang contract" and "sky high film remuneration" in 2018, netizens recently reported that actor Zheng Shuang "obtained an abnormally high film remuneration of 160million yuan and used the" Yin contract "to increase the capital of a company by 112million yuan on suspicion of tax evasion", which once again triggered heated public debate

Over the years, the "Yin-Yang contract" has been widely existed in some film and television industry enterprises and employees, which not only contributes to the "sky high price film pay", but also is suspected of tax evasion, money laundering, etc., which not only hinders the healthy development of the film and television industry, but also has a bad impact on the national economic order, social values and other aspects, so it is urgent to further strengthen the crackdown

"Yin yang contract" makes the production of film and television works a slave to capital

Taking film as an example, its ultimate goal is artistic creation (purpose), not a tool (means) to pursue profits in the market. The purpose of getting box office through entering the film market is to feed artistic creation; As far as the film attribute is concerned, it has both the social attribute of the cause and the economic attribute of the industry, but the social attribute (purpose) comes first, that is, to meet the growing needs of people for a better life, followed by the economic attribute (means), so as to ensure the sustainable development of the cause; For filmmakers, the original intention and dream (purpose) of stepping into the palace of art is to create art classics that are loud, spread and retained, rather than taking making money (means) as the ultimate goal

Unfortunately, at present, some film and television workers and enterprises have given up the super utilitarian nature of art and blindly pursued the profit seeking nature of the market. They have set foot in the stock market and real estate market one after another, and used the funds that should have been invested from the stock market financing (means) into the expanded reproduction (purpose) of film and television works to pay sky high prices and real estate development, taking film and television works as a cash cow to pursue interests. What's more, the production of film and television works that should have been the purpose is transformed into a means of hyping the audience rating, box office and other gimmicks, in order to push up the stock price and even suspected of manipulating the stock market to make huge profits. This upside down phenomenon of "playing with capital, speculating on land, and making concepts" instead of focusing on the "target replacement effect" of film and television production itself is very likely to lead to the production of film and television works becoming slaves to capital, contributing to the wind of literary and artistic impetuosity, and many film and television workers cannot return to the original source of quiet works. The level of some film and television works is still "below the sea level", not to mention "there is a plateau" and there is a lack of "peak"

In a large number of interviews and investigations, it can be found that in order to obtain huge profits, "Yin-Yang contract" or the tip of the iceberg, and the means of "target replacement" can be described as various, which are mainly reflected in the following "tricks" of "washing" money: < /p >

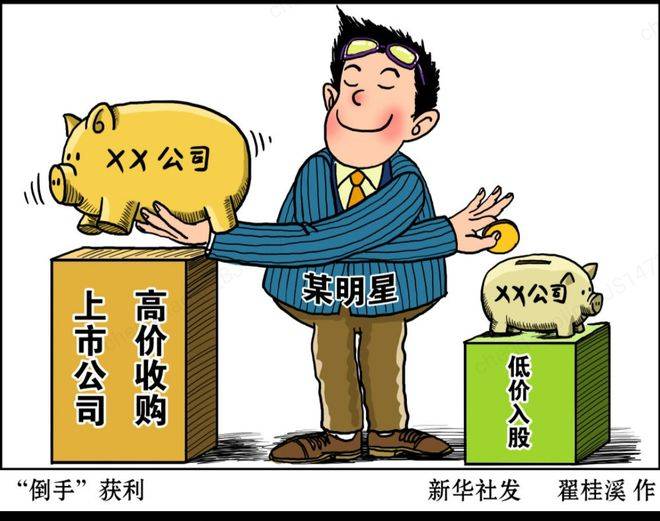

The second is to transform high salary in disguise by means of "capital operation". In the past decade, it is common for many listed film and television companies to acquire small companies with large shares held by some star actors. These "star companies" are often not established for a long time when they are acquired, but their valuations are ridiculously high

Third, use some local tax preferential policies or cultural industry protection policies to reduce tax costs.

these means mainly occur in the operation process of commercial films with a high degree of marketization. However, the creation process of some major theme film and television works also urgently needs to be strictly checked and strengthened from the beginning of the project.

the hidden deep capital operation behind the" sky high price film pay "< /p >

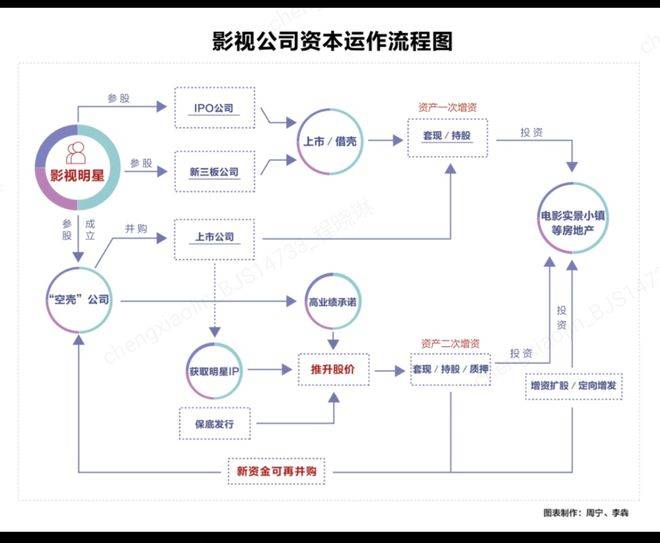

the hidden deep capital operation behind the" sky high price movie pay "deserves high vigilance: different from the general direction of" deleveraging "in the financial industry and capital market, some well-known film and television listed companies have enlarged their leverage in recent ten years, using small and large companies, through" star securitization → target company 'shell' ization → guaranteed minimum issuance, box office fraud to drive up share prices → self buying and self selling, reducing holdings and pledge crazy cash out " The hidden rules and routines of capital operation, digging out small investors in the air, greatly reduced the measures to curb the "sky high pay", triggered huge disputes in the capital market, and even suspected of manipulating stock prices and disrupting the financial order. The specific steps to realize "sky high price film pay" through capital operation are explained in detail as follows: < /p >

the first step is" star securitization ". Over the years, many film and television companies have listed mergers and acquisitions and increased capital and shares frequently involving performing arts stars. Many first-line artists do not read scripts to play capital, and have flocked to become bosses, setting off a whirlwind of" star shareholders "in the film and television industry, so that many netizens satirized that" you can also speculate in stocks by watching gossip ". They have" star shareholders " The new third board film and television companies with a background get together to list. After the transit IPO lands in the A-share market, they can take low-cost means of financing, such as equity mortgage, issuance of bonds, private placement of shares, etc. Through "star securitization", listed film and television companies can not only form interest binding with first-line artists for long-term cooperation, but also cash out small and medium-sized shareholders' funds through a variety of means to offset the income loss caused by the relevant departments to curb the "sky high price film remuneration"

With the significant trend of "star securitization", many film and television companies and well-known artists use the "fan effect" to mislead the market, raise share prices and make wealth, which deviates from the original intention of listing and financing to seek transformation and business expansion. Whether it is mergers and acquisitions, landing on the new third board, IPO, etc., the capitalization of film and television assets does not take reasonable valuation and pricing as the core. In this regard, the relevant securities regulatory authorities frequently issued warnings: "star securitization" has a significant impact on the operation and financial statements of listed companies, and is likely to mislead investors

The second step, "the shell of the target company", that is, "double high mergers and acquisitions + performance gambling" to promote high capital returns. Through the observation of some M & A cases of film and television companies, it is found that stars first set up shell companies, manipulated the valuation, and a few days later made the market value soar hundreds of times by means of backdoor listing and high price mergers and acquisitions, which is the biggest fishiness of mergers and acquisitions of film and television companies. This kind of looting capital game occurs frequently in the film and television industry, with chaos, and presents the "double high" characteristics of high leverage and high valuation

白羊座

白羊座 金牛座

金牛座 双子座

双子座 巨蟹座

巨蟹座 狮子座

狮子座 处女座

处女座 天秤座

天秤座 天蝎座

天蝎座 射手座

射手座 摩羯座

摩羯座 水瓶座

水瓶座 双鱼座

双鱼座